CEOs of eight leading Canadian pension plan investment managers call on companies and investors to help drive sustainable and inclusive economic growth

Aviva Investors and PSP investments to improve sustainability credentials of Soho office building - Aviva Investors

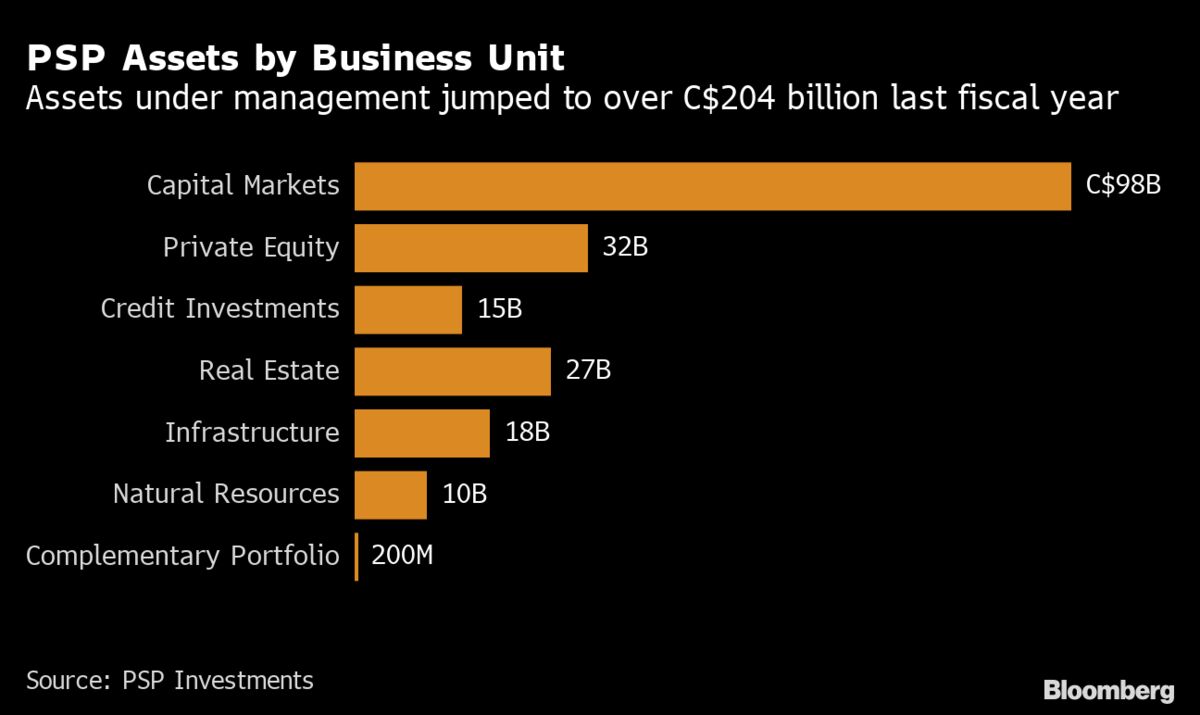

PSP Investments Posts 18.4% Return in Fiscal Year 2021 and Surpasses $200 Billion in Assets Under Management - News hub | PSP Investments